Across Africa’s digital markets, fraud is evolving faster than traditional verification methods can adapt. While many businesses still rely on basic identity checks, Archer explains clearly that “KYC is not enough” in Africa. Fraudsters bypass KYC through duplicate accounts, social engineering, and low-level identity manipulation.

This gap has created strong demand for a KYC solution that goes beyond documents and a KYC provider equipped to detect real fraud patterns across African lenders, banks, and fintech companies.Archer delivers this new approach, offering an anti-fraud platform built specifically for Africa’s risk environment.

KYC Alone Fails in High-Risk African Markets

Archer shows several reasons why simple identity verification isn’t enough:

- Low-income individuals recruited to open accounts for criminals

- Synthetic or duplicate profiles used to bypass basic checks

- Loan applications with fraudulent intent

- Card fraud and unauthorized digital transactions

- Social engineering attacks across platforms

For this reason, companies increasingly need a KYC solution that includes fraud detection tools, behavioural analysis, and ongoing monitoring,not merely identity collection.

Archer, the KYC solution designed for African fraud patterns

Archer combines behavioral analytics, fraud pattern detection, and continuous monitoring into a comprehensive KYC solution for high-risk digital environments.

Key anti-fraud capabilities include:

1. Duplicate account detection

Detects fraudulent users attempting to create multiple or synthetic accounts, a serious issue for lenders and fintechs.

2. Transaction monitoring

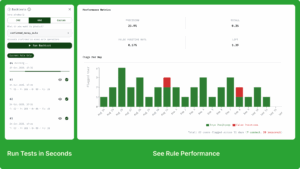

Analyzes behavioural patterns and transactional activity to flag suspicious movements.

3. Case management

Allows fraud teams to investigate cases, manage alerts, and take action quickly.

4. Industry-specific KYC and fraud prevention tools

Archer offers tailored tools for:

- Banks

- Digital lenders

- Fintech platforms

- Online marketplaces

These tools help businesses move beyond traditional verification and adopt a fraud-aware KYC solution.

Built for Africa: secure, compliant, and continuous

Archer also incorporates strong security practices, including:

- Data privacy compliance

- End-to-end encryption

- Continuous security monitoring

This ensures that businesses relying on Archer as their KYC provider can securely process sensitive information without exposing customers to risks.As fraud grows more sophisticated, businesses in Africa can no longer depend solely on basic KYC. Archer provides the fraud-detection-enabled KYC solution the market urgently needs, helping banks, fintechs, and lenders reduce losses and stay compliant.